Taxes

All international students (F-1 & J-1) who resided in the U.S. during 2025 are required to complete federal tax forms. This page is meant to be a general introduction.

Please note: ISSO Advisors are not trained tax professionals and therefore are unable to provide individual tax advising. However, please see the helpful information and resources below.

Who Should File Tax Forms?

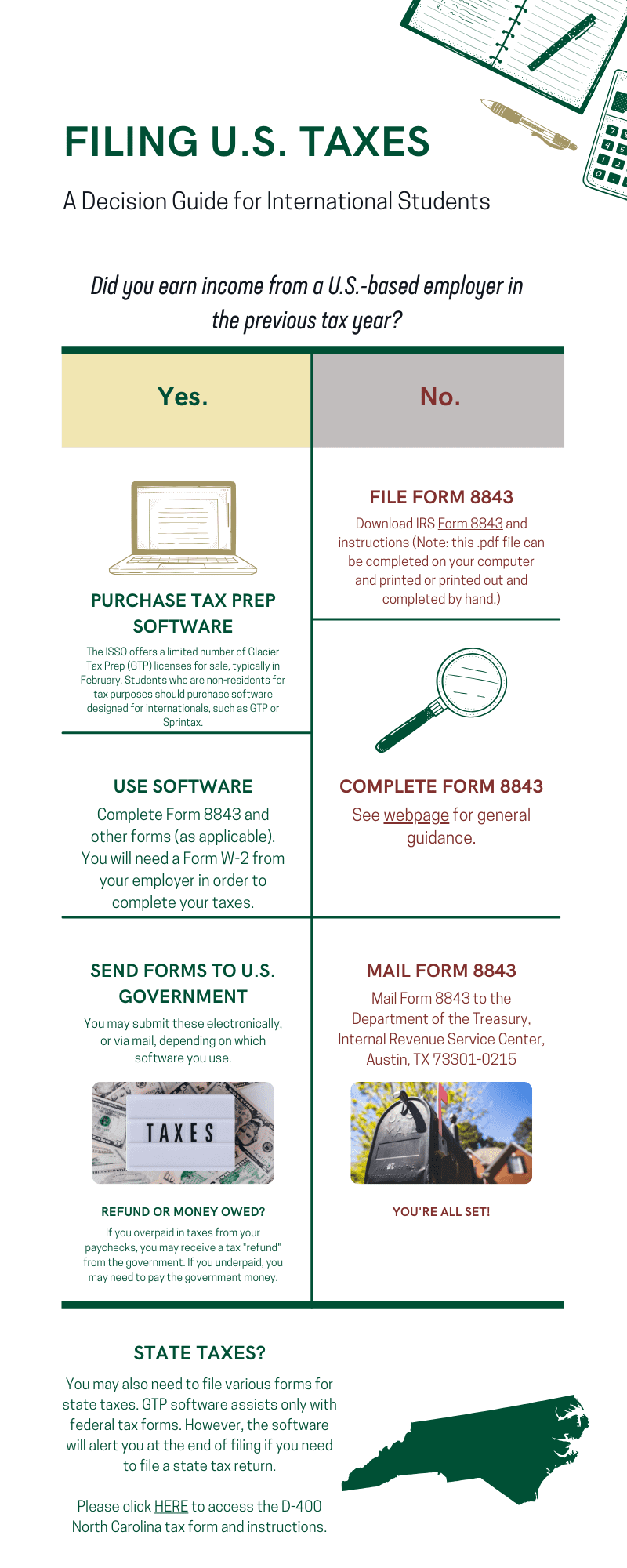

- If you did not earn U.S. sourced income in 2025, you must only file the form 8843 (see section below).

- If you did earn U.S. sourced income in 2025, then you must file additional tax forms. This includes those who received U.S. sourced scholarships. See section below titled, “Additional Form Guidance & Software Assistance (Sprintax Tax Prep)”.

Form 8843 Guidance & Resources

All foreign students, teachers or trainees admitted to the United States on an F, J or M visa, even if he/she had no U.S. earned income for the previous tax year, and their spouses and dependents must file Form 8843.

Exception: If you determine that you are a “resident for tax purposes”, (this means you’ve been in the U.S. in F-1 or J-1 status for more than 5 calendar years) it is not necessary to complete Form 8843 and you should instead file Form 1040 (not ‘NR’).

General Tips

- Download Form 8843 and instructions (Note: this .pdf file can be completed on your computer and printed or printed out and completed by hand.)

- Fill in “First name”, “Last name”, and “Social Security number” (if you have one)

- Fill in the “Address in country of residence” box with your home country address

- Fill in the “Address in the United States” box with your local Charlotte address

Part I: General Information

- Please follow the instructions listed on page 3 – 5 of Form 8843

Part II: Teachers and Trainees (fill out only if you are a visiting professor, scholar or researcher)

Part III: Students (fill out if you are an F-1 or J-1 student or exchange student)

- For #9, enter UNC Charlotte, 9201 University City Blvd. Charlotte, NC 28223, 704‑687‑7781

- For #10, write Tarek Elshayeb, Director, International Student and Scholar Office followed by the remainder of the address in #9 above

- Sign and date the form at the bottom

- Make a photocopy of your completed Form 8843 to keep for your records.

Send completed form 8843 to: Department of the Treasury, Internal Revenue Service Center Austin TX 73301-0215.

The deadline for filing 2025 taxes is April 15, 2026.

Additional Form Guidance & Software Assistance (Sprintax)

If you did earn U.S. sourced income in 2025, then you must file other tax forms, in addition to the Form 8843. As a service to the international community at UNC Charlotte, the ISSO has purchased a license to a specialized software program called Sprintax. This program assists international students and scholars with filing the additional forms needed to complete federal income taxes. Internationals who earn income who are not residents for tax purposes must use special software because the United States has tax treaties with a number of foreign countries. These treaties may reduce a person’s tax rate, vary by country, and are too complex to navigate without specialized software assistance.

How to purchase the Sprintax Tax code (the information below will be updated for the 2025 tax season by 2/5/26):

- Visit the sign-up sheet, to signup to receive the code. Sign-up sheet will close when codes are sold out.

- Payment:

- Currently enrolled students will be charged $5 to their student account – Current students do not pay with credit card.

- OPT/STEM OPT and visiting international faculty and scholars must visit the ISSO Marketplace store, linked in the sign-up sheet, to make a $10 payment to purchase the code.

- Visiting international faculty and scholars who DID NOT earn an income through UNC Charlotte in 2025 do not need to purchase the code.

- An ISSO staff member will review your request for a code, process your payment and email you the tax code within 3 to 5 business days.

1040-NR software (Sprintax) vs regular 1040 software (TurboTax, H&R Block, etc.)

According to the IRS, international students on an F-1 or J-1 visa should file U.S. federal tax form 1040-NR for non-residents, until they pass the substantial presence test and are considered U.S. residents for tax purposes. Sprintax is one of the few tax software products that help complete the non resident version of form 1040 (version 1040-NR). International students are considered non-residents for tax purposes until they have been on F-1 or J-1 visas for part of 5 years or more. Read more about F-1 and J-1 student IRS exemption from resident status.

Once F-1 and J-1 students are classified as U.S. residents for tax purposes, they can complete the regular tax form 1040. Most of the tax software products on the market (TurboTax, H&R Block, etc) assist clients with completing the regular version of form 1040. Residents for tax purposes cannot claim tax treaty exceptions, which is why regular US tax software can be used.

Internal Revenue Service (IRS) Resources

The following web resources can help international students and scholars complete their taxes:

North Carolina & State Taxes

The Sprintax software assists only with federal tax forms. However, the software will alert you at the end of filing if you need to file a state tax return. You may need to file a North Carolina State Tax Return if you earned income from a North Carolina-based sourced, such as the University.

- Please click HERE to access the D-400 North Carolina tax form and instructions.

- You may seek professional support to complete the state tax forms at a reasonable cost using Sprintax.

If you earned income from a non-North Carolina based source (such as for an out-of-state CPT or OPT employer), you may need to file taxes in another state as well. You will need to visit that state’s tax website, a list of which can be found here.

Avoiding Tax Scams

Tax season (February through April) is also a prime season for scammers looking to take advantage of those who are confused about their taxes. Follow these tips to avoid being scammed:

✓ File your tax return as early as possible.

✓ Mail your tax return directly from the post office.

✓ Visit Internal Revenue Service (IRS) Tax Scams/Consumer Alerts page for more information on tax scams